Any comparison of Benfica and Porto is more than a balance-sheet exercise, it's a reading of Portugal's defining football rivalry, 'O Clássico', that splits Lisbon from the north and shapes the competitive and financial tone of the entire league. Benfica brings the scale of a global fanbase, the commercial pull of Lisbon, and an academy pipeline centered on Seixal; Porto counters with a reputation for relentless competitiveness, European savvy, and a finely tuned player-trading machine honed at Olival and the Dragão. Across decades they've traded titles, European nights, and transfer coups, forcing each other to professionalize operations, invest in scouting, and manage risk differently. That context matters: the same headline results can carry different implications depending on stadium economics, squad strategy, and capital structure. With that backdrop, the following analysis reads their numbers not in isolation but through the lens of a rivalry that turns financial choices into on-pitch outcomes.

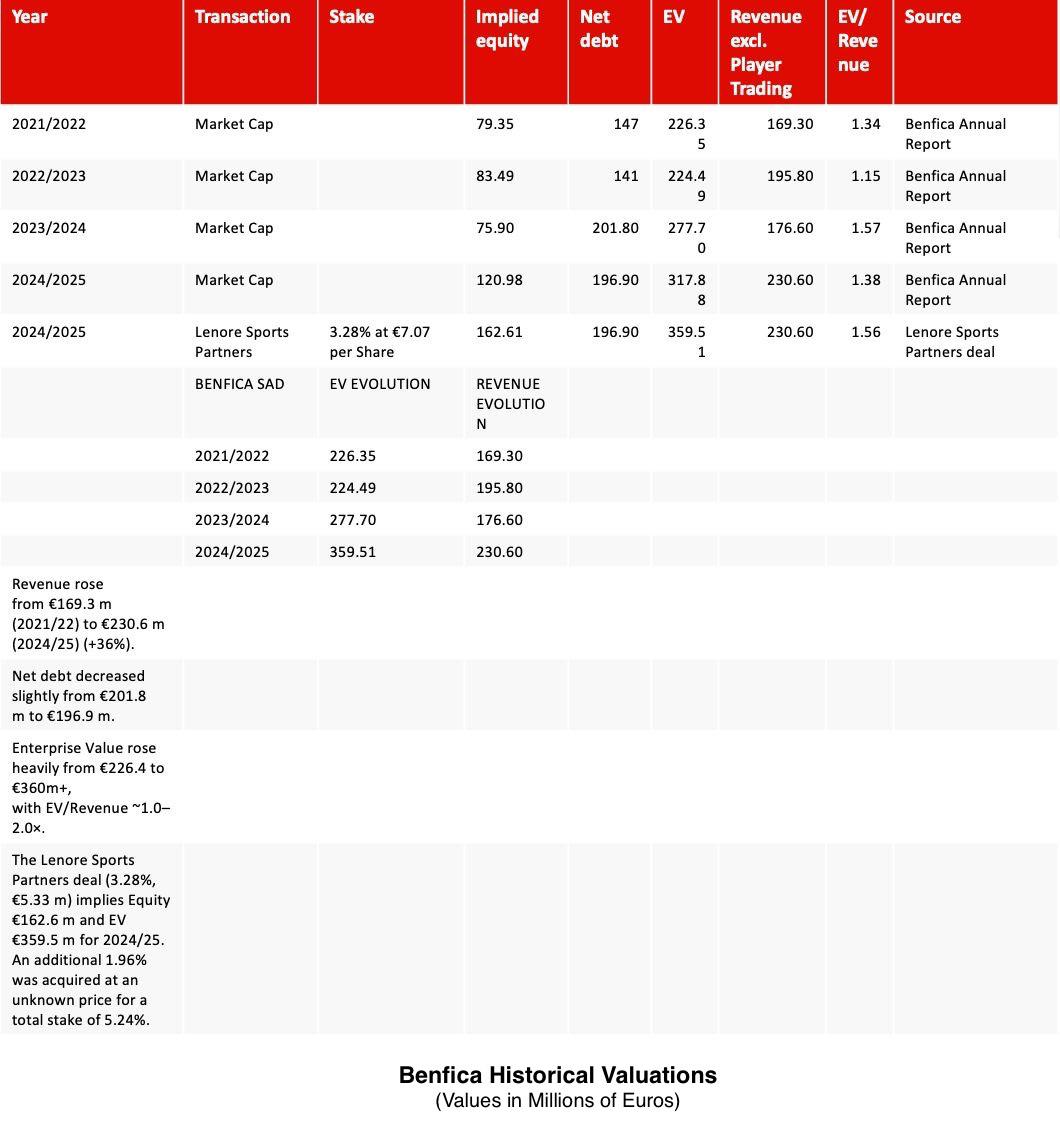

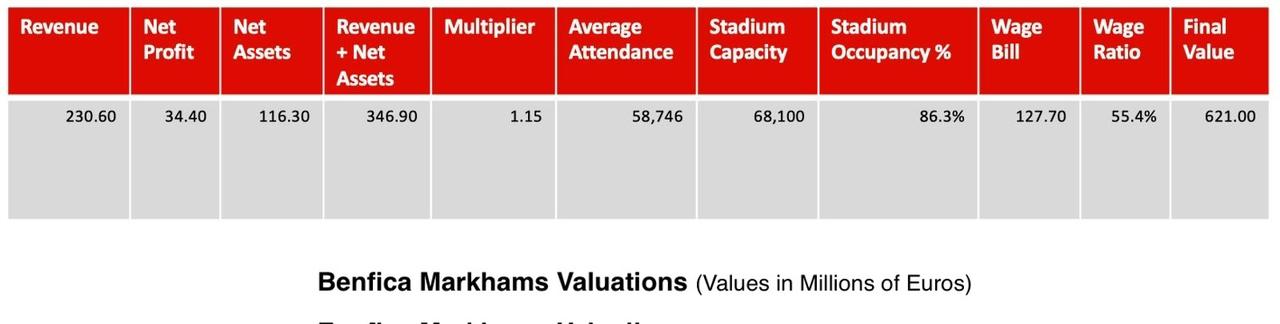

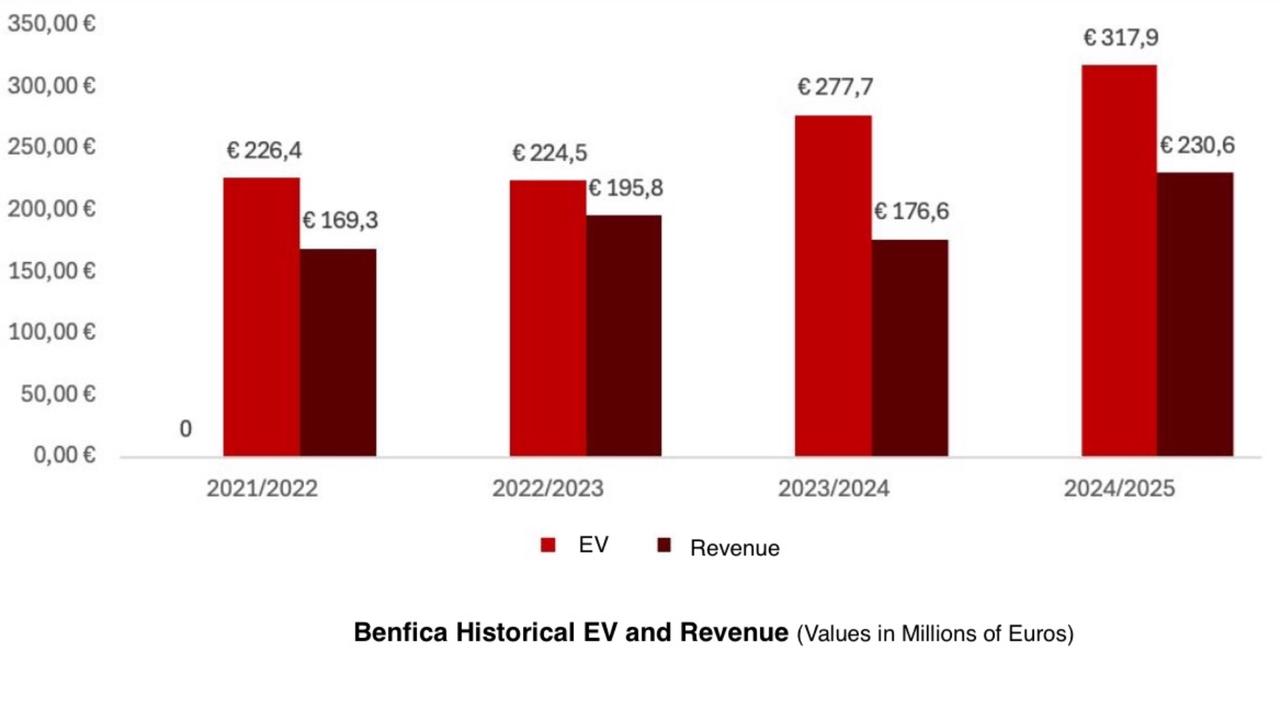

Benfica reads as the larger and steadier platform. Core revenue is about €230.6m and rises to roughly €303.0m with player trading, enough to fund a European level squad without bending cost ratios. Matchday acts like a flywheel, with about 58,700 fans on average and occupancy in the mid eighties, which supports predictable cash flow and pricing power. Costs look controlled rather than cyclical, with wages sitting in the mid fifties as a share of operating revenue and a clean profit for the period. The balance sheet carries positive equity that cushions normal football volatility. On the market snapshot the enterprise value is €347.8m, which equates to about 1.51 times EV to operating revenue and about 1.15 times when including trading.

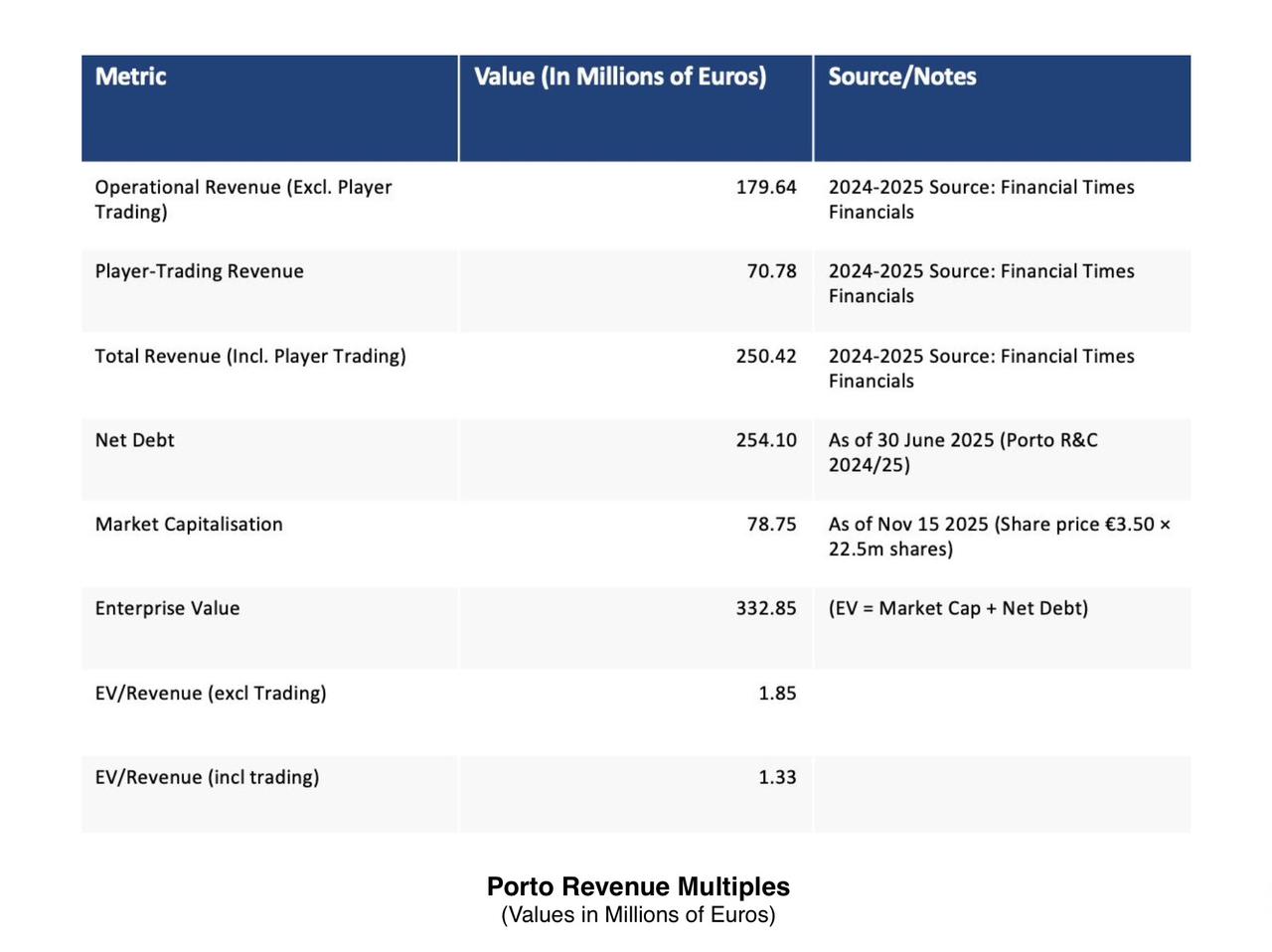

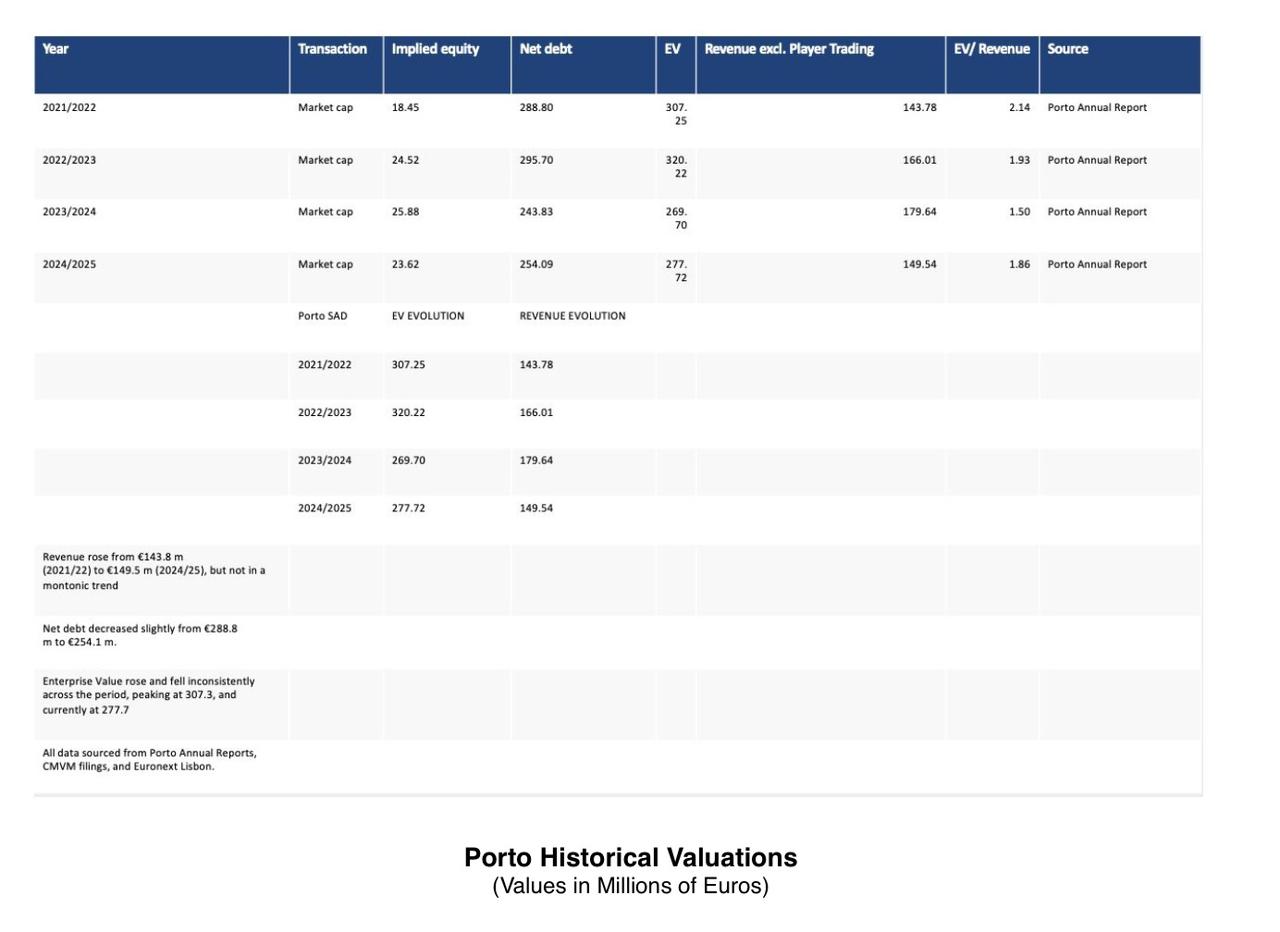

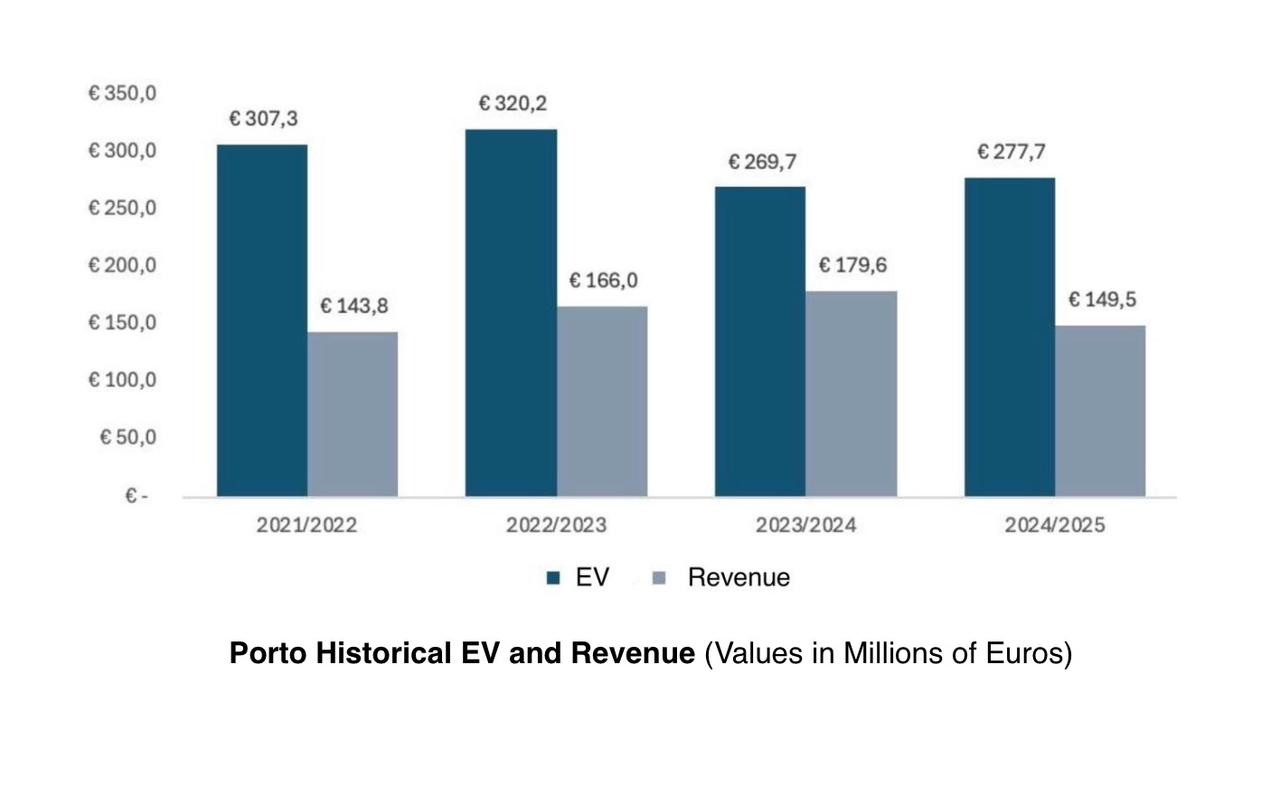

Porto is the tighter operator on a smaller base. Core revenue is around €179.6m and moves to €250.4m with player trading, so the trading engine is a central feature by design. The wage ratio sits a little lower than Benfica and profitability is strong, which points to crisp execution. Matchday demand is healthy for the ground size but meaningfully smaller, with a little more than forty thousand in the stands and occupancy a bit above eighty percent. The balance sheet is more stretched, with heavier leverage and negative equity, which raises sensitivity to the timing of transfers and to European participation. The market snapshot implies an enterprise value of €332.9m, or about 1.85 times EV to operating revenue and about 1.33 times when including trading.

Set side by side the shape of the cash engines is different. Benfica's breadth of income and positive equity act like shock absorbers, so cash generation is less exposed to any one season. Porto brings sharper cost control and a proven recruit and sell loop, but the model leans more on keeping the hit rate high and on avoiding softer European calendars. That difference shows up in price. Enterprise values are in a similar zone, yet investors pay less for each euro of Benfica revenue and more for each euro of Porto revenue, which bakes more execution risk into the Porto case.

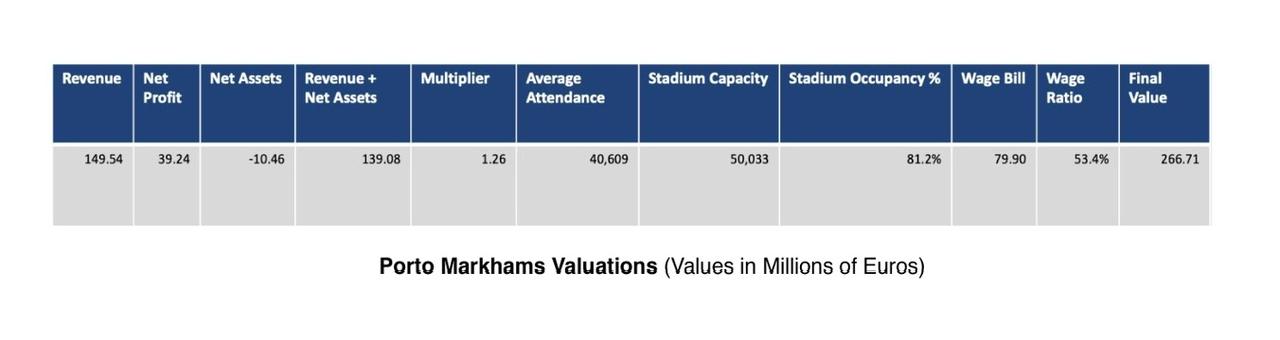

The workbook's Markhams outputs make the contrast explicit. Benfica's final value is €621m versus an EV of €347.8m, which suggests material upside if the current discipline on wages, matchday monetisation, and academy to market conversion holds. Porto's final value is €267m versus an EV of €332.9m, which sits below the market and implies investors already price in a high and steady hit rate. Taken together, Benfica offers broader and steadier cash generation at a lower revenue multiple and screens as the cleaner risk reward. Porto remains a high quality operator with a powerful trading engine, but the equity case is simply more exposed to the calendar and to form.

Taken together, the figures point to two credible but different financial profiles. Benfica combines scale, diversified income, strong matchday demand, and positive equity, which together support steadier cash generation and a valuation that is anchored by breadth rather than a single driver. Porto shows efficient operations and a well run trading engine that can produce strong profitability on a smaller base, although outcomes depend more on transfer timing and European participation. In valuation terms the snapshot prices each euro of Benfica revenue at a lower multiple and each euro of Porto revenue at a higher multiple, which reflects differing views on risk, growth, and execution. The choice between the two is therefore a matter of emphasis: preference for size and balance sheet strength on one side, or confidence in continued operational precision and talent monetization on the other. Future developments in attendance, sponsorship mix, and European performance will be the key signals for which model compounds faster over time.